A: MNsure, (pronounced MINN'-shur), is the state's new online health insurance marketplace, sometimes called an exchange. Minnesota consumers and small businesses with up to 50 full-time employees will be able to obtain health insurance through MNsure. Options will range from free or low-cost policies for government health insurance such as Medicaid and MinnesotaCare to commercial health plans.

MNsure 101: Your guide

A: "Obamacare" is a nickname for the Patient Protection and Affordable Care Act, the federal health care overhaul. "Obamacare" started out as a disparaging term coined by opponents of the law. But President Obama said he likes it and it's evolved into a largely neutral reference.

The online insurance marketplaces such as MNsure are a key part of the law because they provide the gateways for individuals and small groups to obtain health coverage. As the Kaiser Family Foundation described them, the exchanges are intended " to create a more organized and competitive market for health insurance by offering a choice of health plans, establishing common rules regarding the offering and pricing of insurance, and providing information to help consumers better understand the options available to them."

Q: Why does Minnesota need its own exchange? Why not just use the federal exchange?

A: Supporters of Minnesota building its own exchange argued that Minnesota could build a system that benefitted from the state's long history of health care policy innovation and cost containment.

They also maintained that Minnesota would wind up with an exchange tailored to the needs of state residents rather than a "one-size-fits-all" federal exchange.

Q: Is MNsure happening everywhere?

A: MNsure will be available to residents of Minnesota. Some form of exchange will be available in every state, but who operates the online marketplaces will vary. Minnesota is one of 16 states and the District of Columbia running its own marketplace.

Seven states, including Iowa, are partnering with the federal government to operate their exchanges. The federal government will solely run marketplaces in the remaining 27 states, including Wisconsin, North Dakota and South Dakota.

Q: Can I just use the federal exchange?

A: Only if you live in a state that's opted for the federal exchange

Q: If I live in another state, can I use MNsure?

A: No. You must use the online marketplace in the state where you reside.

Q: Why is MNsure happening now?

A: The federal health care law requires the online insurance marketplaces to start operating Oct. 1, 2013. The aim is to give consumers plenty of time to choose plans before the Affordable Care Act's individual mandate takes effect January 1, 2014, requiring most Americans to carry health insurance or pay a tax penalty.

A: Minnesotans who have health insurance through a large employer won't be using MNsure.

MNsure's primary constituencies include people shopping for individual, family, or small business coverage. People who've bought such plans through an insurance agent or broker can continue to use an agent. But federal subsidies are only available if your agent or broker is registered to sell on MNsure.

People buying on their own using MNsure can get subsidies if they're eligible.

MNsure will also serve as the entry point for enrolling in two government insurance programs: Medical Assistance (Minnesota's Medicaid program) and MinnesotaCare. These are free or low-cost programs for people with incomes below 200 percent of the federal poverty level.

MNsure does not affect people enrolled in Medicare, the government insurance program for elderly Americans.

A: The website goes live October 1, 2013 and is designed to offer one-stop shopping for insurance. After entering income and other basic information Minnesotans will be routed either to government insurance programs -- if their income qualifies -- or to commercial plans.

MNsure will allow side-by-side comparisons of commercial plans offered by different companies or with differing levels of coverage. MNsure will display extensive information about premiums, and out-of-pocket costs such as co-pays. MNsure will also let you know if you qualify for tax credits, or other financial help.

While these marketplaces have been compared to online travel sites that allow flight and cost comparisons, insurance is much more complex and consumers will encounter dozens of variables to sort through.

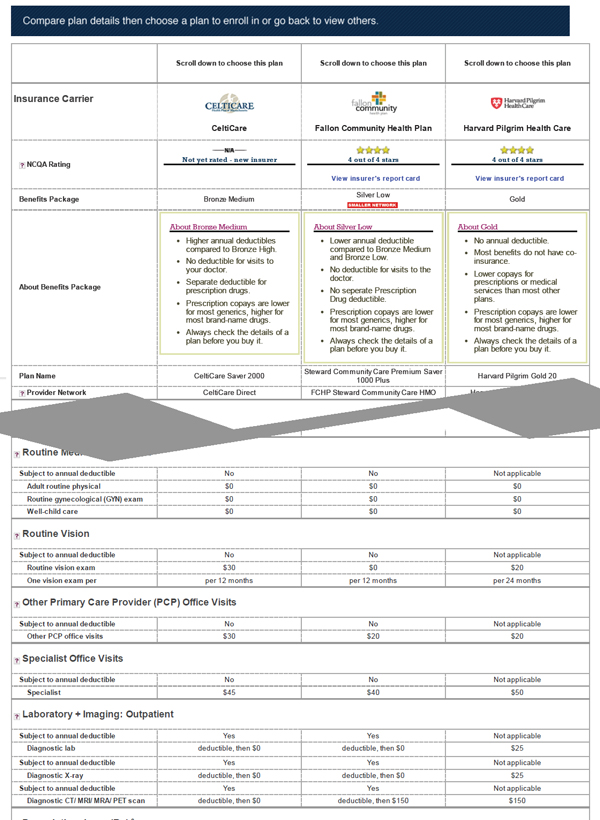

Below is an example of the complexity the Massachusetts exchange *may* display. Click to view the PDFs. What you see on MNsure may differ from this example.

Important note: This shows how the Massachusetts exchange displays the terms of three plans offering different levels of coverage. The premium rates are based on a family whose adults are in their 50s with income that's too high to qualify for tax subsidies. The Minnesota rates for comparable family coverage are likely to be lower since Minnesota has the lowest average sticker prices among the states that have reported premiums so far.

A: Go to the MNsure website http://mnsure.org and the system will guide you through enrollment step-by-step starting October 1, 2013.

Q: Do I have to figure this out myself or is there help?

A: There are many sources of help.

MNsure toll-free call-center 1-855-3-MNSURE, or 1-855-366-7873. Operators are available to answer questions in English, Spanish, Hmong and Somali. Callers will also have access to interpreter services in at least 140 other languages.

The call center is open Monday through Friday, 7:30 a.m. to 8 p.m., and on Saturdays from 9 a.m. to 4:30 p.m., during the open enrollment period, which ends March 31, 2014.

The state is providing "navigators" and "in-person assisters" to help Minnesotans enroll in the health plans sold on MNsure. They'll provide education, impartial information and assistance signing up. They'll be paid through government grants and by MNsure on a per-enrollment basis, not commissions.

Certified application counselors will help consumers through the MNsure enrollment process as part of their current jobs at hospitals; clinics; associations and other groups.

Licensed insurance agents and brokers who complete a MNsure training course will also be able to assist consumers seeking insurance on the marketplace. Brokers and agents also must be registered with MNsure for a client to receive federal tax subsidies if the client is eligible.

Unlike navigators/in-person assisters/certified application counselors, licensed insurance agents/brokers will be paid on commission by insurance companies. Agents/brokers must disclose their financial arrangement with insurers to consumers.

Q: How much will I have to pay for insurance?

A: That depends largely on how much you want to pay in premiums and whether you qualify for income-based tax credits. The least expensive option on MNsure is available to a 25-year-old non-smoker living in the Twin Cities.

The plan carries a premium of about $91 a month. Someone who qualifies for tax subsidies would pay even less. Premium rates though will vary by region, age, and whether you smoke.

Q: I own a small business. How does MNsure affect me?

A: If your business employs fewer than 50 full-time employees, you don't have to provide health insurance under the health care law.

But if you'd like to offer your employees coverage, MNsure will have a feature available that most states won't offer for another year.

MNsure will allow workers to choose from health plans from a variety of companies, allowing more choice than the employer picking one insurer for all, as will be the case in most other states.

In addition, some small businesses may be eligible for tax credits, depending on the number of employees, average wages, and the employer's contribution towards health insurance. Small business cost calculator

Q: What if I have no insurance and I do nothing?

A: Unless you are a member of one of the groups that's exempt from the Affordable Care Act's mandate to obtain health insurance, you will be subject to a $95 fine or 1 percent of your taxable income, whichever is greater starting next year. The fine increases substantially in subsequent years.

Those exempt from the mandate include certain religious groups; American Indian tribe members; people who don't earn enough income to file a tax return; and people who'd have to pay more than 8 percent of their income for health insurance, after taking account of any employer contributions or tax credits.

Q: What if I have insurance, do I need to pay attention to MNsure?

A: That depends on what kind of insurance you have and if you're eligible for tax credits.

Probably not, if you get your insurance through a large employer or your current insurance meets minimum essential coverage under the health care law, which may even include "bare bones" plans. Read more at Why Health Law's 'Essential' Coverage Might Mean 'Bare Bones'

Yes, if you have insurance now that covers a specific disease or illness only, you will have to get new insurance because these plans don't meet minimum requirements under the Affordable Care Act.

Yes, if you buy an individual or family plan or coverage for a small business with fewer than 25 employees and want to seek federal premium subsidies. These are only available for people who buy on MNsure themselves or through an agent or broker registered to sell on MNsure.

No, if you're on Medicare.

Q: If I use MNsure, can I keep my doctor?

A: If you buy health insurance as an individual or for your family, it's possible you might not find a plan that includes your current doctor; it depends on the plan you choose and whether your doctor is part of the insurer's provider network. Some people who'll be buying insurance on the new marketplaces will be uninsured and don't have a regular doctor. Still, experts say no one will assign you a doctor, you'll still be able to choose your own.

If you currently obtain health insurance through work, and your employer stays with the same plan, you won't have to change doctors. But as always, employers can change plans regardless of the the impact of the health care law. If your employer switches plans, your network of doctors and clinics may also change, whether or not the new plan is one offered on MNsure.

A: You get it immediately as a discount on your premium. So if the plan is a $1,000 and you get a $500 tax credit, you only have to pay $500.

Q: If my employer offers insurance but it's too expensive for my budget, can I buy a plan on MNsure?

A: Any Minnesota resident can buy insurance on MNsure whether or not your employer offers coverage. But for people who choose MNsure over a workplace plan, there's a relatively high bar to qualify for federal subsidies that bring down the cost of buying insurance on your own.

An employer's plan would have to eat up more than 9.5 percent of your household income. If your employer coverage costs less than 9.5 percent of your household income, you could still buy insurance on MNsure but couldn't take advantage of the law's tax subsidies.

For the state's median household income of $58,476, 9.5 percent amounts to about $463 per month.

A: Comparing health insurance policies is complicated because the coverage can vary so widely from one plan to another. For example, one policy might pay most of your health care costs if you're hospitalized, while another requires you, the consumer, to pay a hefty chunk of the expenses if you get sick. And of course the premium cost typically goes up as the coverage gets more extensive.

The federal health care law divides health plans to be sold on health insurance exchanges such as MNsure into four categories, which named after metals: bronze, silver, gold, and platinum -- the more precious the metal, the more generous the plan on average -- and the higher the premiums.

The tradeoff is this: the higher the premiums and the more extensive the coverage, the lower the out-of-pocket costs such as deductibles and co-pays.

- Bronze plan:Will pay about 60 percent of the cost of the plan's benefits; the consumer pays the rest in deductibles, copays and coinsurance.

- Silver plan: Will pay about 70 percent of the enrollees' health care costs on average; the consumer is responsible for the remaining 30 percent.

- Gold plan: Will pay about 80 percent of the costs; the consumer is responsible for the remaining 20 percent.

- Platinum plan: Will pay about 90 percent of the costs; the consumer is responsible for the remaining 10 percent.

This is how one state's exchange displays the various metal levels. What you see on MNsure may differ from this example.

Important note: This shows how the Massachusetts exchange displays the various metal levels available to a family whose adults are in their 50s with income that's too high to qualify for tax subsidies. The Minnesota rates for comparable family coverage are likely to be lower since Minnesota has the lowest average sticker prices among the states that have reported premiums so far.

The health care overhaul coverage team:

Elizabeth Stawicki, JD, Reporter

Elizabeth Stawicki, JD, covers health care reform for MPR News. Her reporting often appears nationally as part of collaboration between MPR/Kaiser Health News/NPR called, "Health Care in the States."

Catharine Richert, Reporter

Catharine Richert covers politics and health care for MPR News, and writes PoliGraph, a fact-checking feature that gets behind the spin in Minnesota politics.

Bill Catlin, Editor

Bill Catlin is an editor responsible for directing MPR News' business, economics, and Affordable Care Act coverage.