Targets of tax increase have mixed reactions

Go Deeper.

Create an account or log in to save stories.

Like this?

Thanks for liking this story! We have added it to a list of your favorite stories.

The Senate tax hike is either down-right hostile to business owners, or a sound way to fund the education system, or a good idea that can't be implemented well. That's some of the range of opinion among Minnesotans would have to pay more under the Senate's proposal.

The plan zeroes in on joint filers with a combined annual income of $250,000 or more, and single filers making more than $141,000 a year.

To Jim Marchessault, who runs a business card company, the plan represents bad policy on several fronts.

"To increase taxes when we have a state surplus, that's insane," says Marchessault, who cringes at how businesses will respond to the tax hike. "I don't think the Legislature is thinking about businesses that will leave the state."

Turn Up Your Support

MPR News helps you turn down the noise and build shared understanding. Turn up your support for this public resource and keep trusted journalism accessible to all.

Marchessault says he and his business partners already have to borrow money from a bank in order to pay their personal income taxes. He expects that situation would grow worse if income taxes go up.

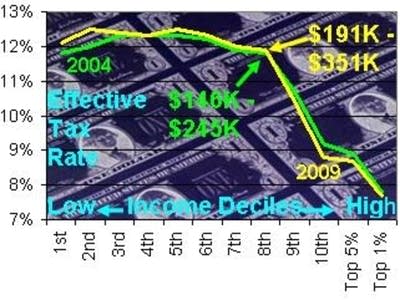

Depending on how you count, Minnesota's highest income earners either pay a lot in taxes, or they pay less than others.

Consider the highest 10 percent of households with the highest incomes. They bear more than a third of the burden for state and local taxes. But the highest income households pay a smaller portion of their income in state and local taxes than other Minnesotans do.

A recent state study found that on average, Minnesotans pay 11.6 percent of their incomes in taxes. By contrast, people making more than $712,000 had to a tax bite of just 9.2 percent of their incomes.

But for some taxpayers who would be hit by the tax plan, like Marlin Schutte, it's hard to believe anyone might consider him wealthy.

"Rich? No. Absolutely not," he says. "I still watch where my money goes."

Schutte is the president and CEO of Seal Tech Industries in Chanhassen, a company that produces gaskets and brings in about $2 million a year.

Schutte says he's opposed to the Senate's proposed tax increase because it will penalize people for doing well in business.

"If you have a good year and all of a sudden you have some good income coming out of there, you're going to get pushed into the upper bracket," he says.

As for the larger aims of the tax increase proposal, which is to raise more money for education, Schutte says he's not convinced it's necessary. He taught for nine years and says he's seen a lot of "fat" in the system.

"The question you have to ask is: 'How much is enough?" and the answer to that is 'Just more than we get,'" he says.

But spending more on education is a good thing as far as one mother is concerned. Terry Bly, a psychotherapist with a three-year-old son, says she and her husband are close to hitting one of the top tax brackets. And they're willing to pay higher taxes if it translates to better schools. They're especially concerned since their son will enter school next fall.

"I've been doing a lot of research with schools, and seeing some of the weaknesses in the public school system, I'm pretty passionate about wanting to see our school system improve. And if they take our tax money and put it towards K-12 funding, then I'd definitely be looking to see improvements in the school system, since I'm paying a lot of attention to that anyway," says Bly.

Another one of Minnesota's "top earners," Mark Rancone, would normally agree. He's a vice president of Roseville Properties, and he says in theory, he wouldn't object to paying higher taxes for better education.

"I don't have a basic fundamental problem with sharing some of my good fortune," he says. But Rancone says at this point, he's lukewarm on the prospect of paying more taxes to fund schools, because he's lost confidence in the legislators who would allocate the money.

"No offense to anyone in particular, but they're just not capable people to manage the kind of dollars that are run through state government," Rancone says.

Given his lack of confidence in the Legislature, Rancone hopes Gov. Pawlenty will veto the Senate's proposed income tax increase.

Dear reader,

Your voice matters. And we want to hear it.

Will you help shape the future of Minnesota Public Radio by taking our short Listener Survey?

It only takes a few minutes, and your input helps us serve you better—whether it’s news, culture, or the conversations that matter most to Minnesotans.